Millenials and Communal Living

mattwigway

A Citylab article from a few weeks back observes that the rate of household formation among millenials remains low. A large proportion of millenials are still living with their parents, certainly a sign of economic hardship. However, the article also notes that it is “alarming” that when millenials eventually do leave their parents’ households, they often do not form new households but instead live with other adults. The article views this as a sign of economic malaise, which indeed it is, but fails to note that there are concomitant social changes that drive millenials to live together, independent of economic concerns.

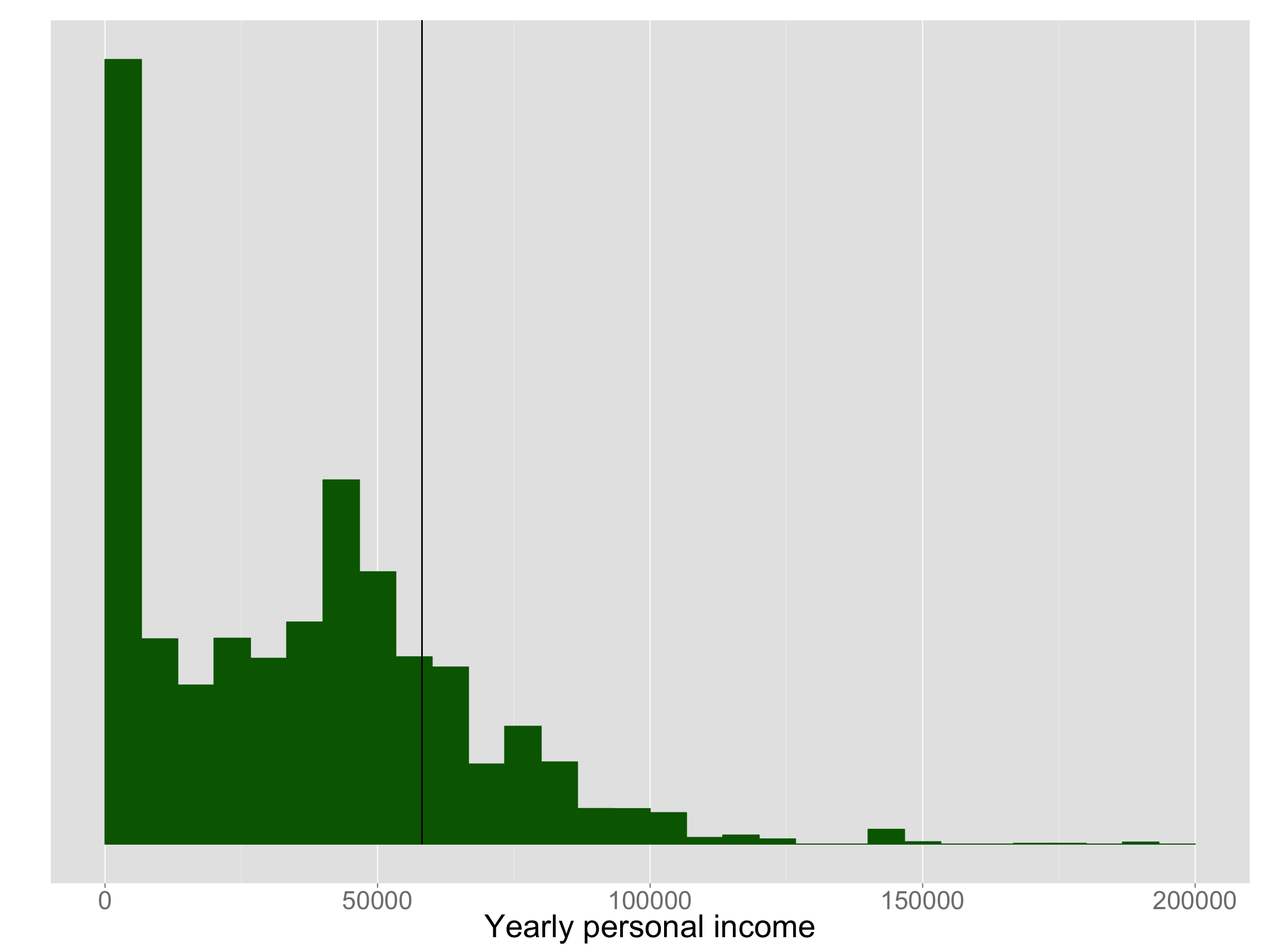

The article, and likely society at large, assumes that the reasons millenials are living together is that they cannot afford to live alone, that young adults would not choose to live with unrelated adults unless forced to to make ends meet. To some extent, this is true: rents are high and many millenials struggle to afford them, and live with others for this reason. However, there is a significant minority who could afford to live by themselves, but choose not to. The below plot shows the distribution of personal (not household) income for millenials (age 18-34) in the District of Columbia (one of the more expensive places to live in the country) who live in households comprised of at least three 18-34 year olds, and no others. The data is derived from the 2009-2013 American Community Survey Public Use Microdata Sample.

Median monthly housing costs per housing unit in the District of Columbia were \$1,454 in 2013 (source). Going by the common rule of thumb that housing costs should be less than 30% of income, one finds that to afford the median rent in DC one must make \$58,000 per year, which is the location of the black line on the above chart. 21% (+/- 4%, 95% confidence interval using the replicate weights method to calculate standard errors) of 18-34 year olds currently living with other 18-34 year olds in the District make more than that, and could potentially afford to live alone. 21% isn’t huge number (put another way, 79% of 18-34 year olds who live together in DC couldn’t afford to live alone), but it is a significant minority.

I see several obvious explanations. One is simply that millenials don’t like to live alone. This can hardly be called out as a sign of economic malaise; rather it is a sign of social change. Millenials find social benefits in communal living, from forming lasting friendships to just having someone to hang out with in the evenings. Additionally, millenials who could afford to live alone but are choosing to live together are not just letting the savings evaporate into thin air; they are either spending them on other goods and services (a boon for the local economy) or saving them (a boon for themselves later in life).

Another possible cause has to do with where people are choosing to live. More and more, millenials are choosing to live in central areas of cities, where rents are higher and space is at a premium. Many of the people who could afford their own place somewhere in DC might not be able to afford their own place in the neighborhood in which they would like to live. Again, this is not necessarily a sign of economic malaise. There is not enough housing in the core for everyone who would like to live there to live alone, and this is reflected in housing prices. Many millenials are making a perfectly rational economic choice, choosing the benefits of living in their desired neighborhood over the sacrifice of not having their own place. The District of Columbia is fairly compact, but there are certainly lower-cost areas that may not be seen as desirable by millenials.

Finally, there may be a supply-side problem. The Census numbers are based on what people who currently live in the District pay. If you’re trying to establish a new household, you are renting or buying not from the pool of all properties, but from the pool of properties currently on the market. It’s entirely possible that median cost of properties on the market is higher than the median cost of properties that are currently occupied; people may be less likely to leave more reasonably-priced properties. Zillow, for example, finds that the median price of District of Columbia properties listed for rent there is \$2,300 per month. (This discrepancy could also be due to selectivity bias, i.e. more expensive than average properties being listed on Zillow).

Economic hardship certainly is a huge factor in millenials choosing to live together, and certainly in choosing to continue living at home. The majority of millenials who live with other adults in DC could not afford the median housing cost in the District. However, affordability is not the only factor; there is also a significant minority of millenials who choose to live with a group of other adults, even though they could afford to live by themselves. We should be careful to recognize the effects of social change as well as economic hardship on household formation.